biosimilars are FDA-approved medications derived from living organisms that demonstrate high similarity to reference biologic products in terms of safety, purity, and potency. Unlike generic drugs which copy small-molecule medications exactly, biosimilars are complex biological products made from living cells. The first FDA-approved biosimilar, Zarxio, entered the market in March 2015. As of 2025, over 70 biosimilars have been approved by the FDA, though only about 40 are commercially available. This is crucial context because while biosimilars offer significant cost savings-typically 10-33% less than their reference products-insurance coverage practices often undermine their potential benefits.

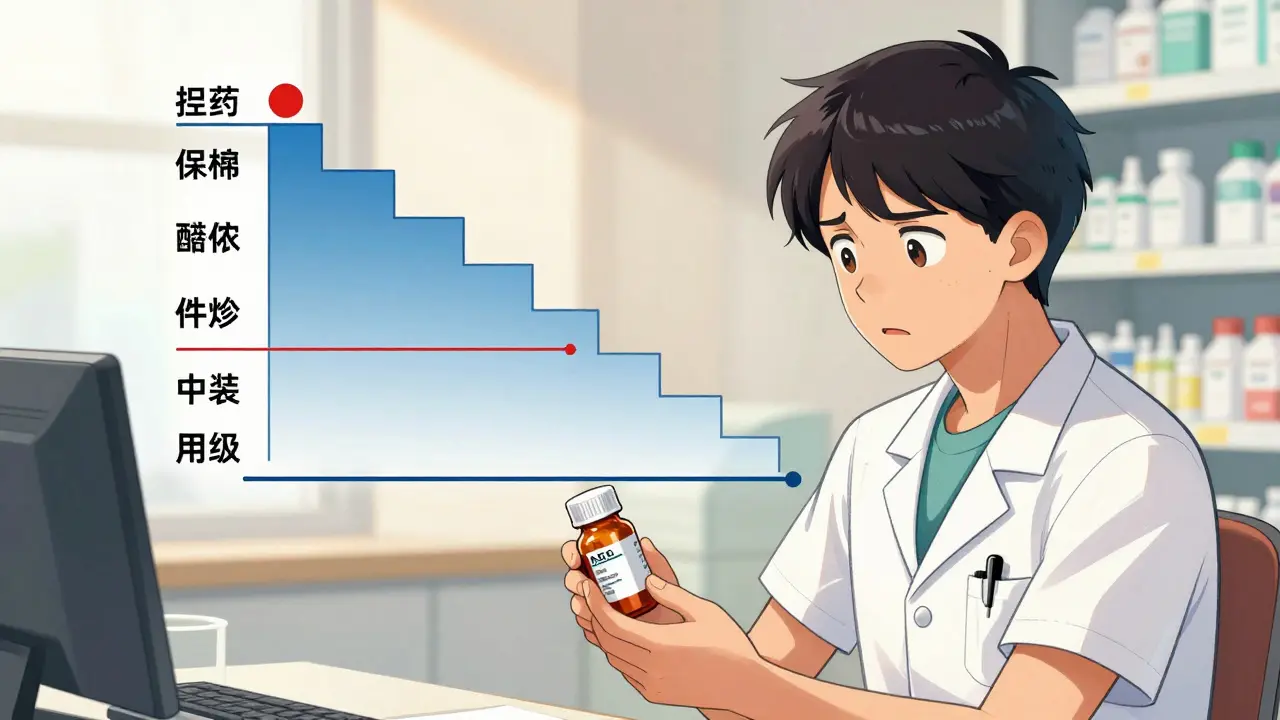

How Insurance Tiers Work for Biologics and Biosimilars

Most insurance plans use multi-tiered formularies where biologics sit in the highest-cost specialty tiers (Tier 4 or 5). Patients typically pay 25-33% coinsurance for these drugs, translating to $1,100-$1,500 monthly out-of-pocket costs for a $4,000-$5,000 dose. Medicare Part D is the federal prescription drug program for seniors, which sets formulary rules for 37 million beneficiaries. In 2025, 99% of Medicare Part D formularies placed Humira and its biosimilars on the same cost-sharing tier, with almost none using preferential tier placement to encourage biosimilar use. This means patients see little financial incentive to switch. For example, insulin biosimilars face even steeper barriers: 80% of Medicare Part D plans cover branded Lantus insulin, but less than 10% cover insulin biosimilars.

The Prior Authorization Maze

Prior authorization is a process where insurers require doctors to prove medical necessity before covering a drug. For biologics, this is almost universal. In 2025, 98.5% of plans covering Humira and its biosimilars required prior authorization for both, with no plans applying less restrictive rules to biosimilars. Providers must submit detailed documentation including treatment history, failed alternatives, and specific dosing justifications. Approval takes 3-14 business days, causing treatment delays. Step therapy protocols often force patients to try biosimilars first before approving reference products, creating unnecessary hurdles. A rheumatology case study showed a patient with severe rheumatoid arthritis faced a 28-day treatment delay due to mandatory biosimilar trials.

Current Coverage Trends in 2025

Despite FDA approval of 8 adalimumab biosimilars by mid-2023, coverage remains uneven. Humira maintained nearly universal Part D formulary coverage, while only 50% of plans covered any biosimilar. The most covered biosimilar was adalimumab-adbm (Cyltezo), which benefits from its "interchangeable" designation allowing pharmacist substitution. However, this applies only to rare low-concentration Humira formulations. Major insurers like United Healthcare, CVS, Centene, and Cigna still don’t cover any insulin biosimilars. PBMs (Pharmacy Benefit Managers) like Express Scripts, OptumRx, and CVS Caremark exclude Humira from standard commercial formularies to push patients toward preferred biosimilars. Express Scripts’ 2025 strategy placed multiple biosimilars on Tier 3 (25% coinsurance) while Humira was excluded entirely from all commercial plans.

How Coverage Practices Impact Patients and Providers

The financial impact on patients is minimal despite lower biosimilar list prices. Medicare Rights Center analysis found that when biosimilars and reference products share the same tier, patients pay $1,200 monthly for Humira versus $1,150 for biosimilars-just $50 in savings. Providers face heavy administrative burdens. A 2024 Alliance for Patient Access survey revealed 78% of rheumatologists spend 3-5 hours weekly managing prior authorization requests, with 65% reporting treatment delays for 1-2 patients monthly. These delays can worsen chronic conditions like rheumatoid arthritis or Crohn’s disease, leading to higher long-term healthcare costs.

What’s Changing in 2026

Regulators are taking action. CMS has expanded formulary monitoring to include tier placement comparisons between reference products and biosimilars following the OIG’s November 2024 report. Industry analysts project biosimilar market share will jump to 40% by 2027 as PBMs adopt exclusionary strategies. The Congressional Budget Office estimates biosimilars could reduce federal spending by $5.3 billion annually by 2030 if coverage barriers are addressed-up from just $1.8 billion under current patterns. However, this depends on stricter enforcement of non-discriminatory tiering rules under the Inflation Reduction Act. For now, patients and providers must navigate a complex system where coverage rules vary wildly between insurers and drug classes.

How do biosimilars differ from generic drugs?

Biosimilars are complex biological products made from living cells, while generics are exact chemical copies of small-molecule drugs. Biosimilars must demonstrate high similarity to reference biologics but aren’t identical due to manufacturing complexity. Generics require less rigorous testing than biosimilars because their chemical structure is simpler and easier to replicate.

Why don’t insurance plans cover biosimilars better?

Insurers often place biosimilars on the same tier as reference products, eliminating financial incentives for patients. Some PBMs and drug manufacturers use anti-competitive tactics like exclusive contracts or "pay-for-delay" agreements to block biosimilar adoption. The FTC has raised concerns about these practices, but enforcement remains inconsistent.

What’s the role of PBMs in biosimilar coverage?

PBMs (Pharmacy Benefit Managers) negotiate drug prices and manage formularies for insurers. They control which drugs are covered and at what tier. In 2025, major PBMs like Express Scripts excluded Humira from all commercial formularies while placing biosimilars on preferred tiers. This strategy forces patients toward biosimilars but creates administrative complexity for providers.

Can pharmacists substitute biosimilars for reference products?

Only "interchangeable" biosimilars allow automatic substitution. As of 2025, just three adalimumab biosimilars (including Cyltezo) had this designation, and even then, substitution only applies to low-concentration Humira formulations. Most biosimilars require a new prescription for each switch, limiting pharmacist flexibility.

What should patients do if denied coverage for a biosimilar?

Patients can appeal denials through their insurer’s process, often requiring doctor-submitted clinical evidence. Many states have laws requiring insurers to cover medically necessary drugs within 14 days. For Medicare Part D, patients can also switch plans during open enrollment (October 15-December 7) to find better coverage. Nonprofits like Patient Advocate Foundation offer free assistance with coverage disputes.

Amit Jain

February 6, 2026 AT 11:20This is total bullshit.

Insurance companies are screwing patients over.

They're not covering biosimilars properly.

It's all about the money.

Big pharma is controlling everything.

Wake up people! We need to fight this.

It's not just about money; it's about healthcare access.

They're deliberately making it hard.

This system is broken.

Someone needs to do something.

Stop being passive.

This is a travesty.

It's time to take action.

I'm done waiting.

Sarah B

February 8, 2026 AT 09:32US leads biosimilars. Stop complaining.

Heather Burrows

February 8, 2026 AT 12:31I don't know why people are making such a fuss. It's obvious insurance companies have their reasons. We should all just accept it. The system isn't perfect, but it's better than nothing. Maybe we should just be grateful. It's not that bad. I mean, think about it.

Marcus Jackson

February 9, 2026 AT 00:59As a pharmacist, I can tell you that biosimilars are great. Insurers are doing their job. It's complicated. People don't understand the science. They need to educate themselves.

Natasha Bhala

February 9, 2026 AT 04:05Hey Marcus! You're right. Biosimilars are the future. Its going to be okay. We just need to keep pushing. Don't worry. We'll figure it out. <3

Gouris Patnaik

February 9, 2026 AT 12:07India is doing better than US. We have better policies. You all don't understand the real issue. It's about national pride. Biosimilars are a tool for self-reliance. Stop comparing to US. We know better.

Jesse Lord

February 10, 2026 AT 12:09I hear you. It's tough for patients. Let's work together. We can make a difference. Everyone deserves access. Let's support each other. It's possible to fix this. We just need to try.

AMIT JINDAL

February 11, 2026 AT 22:43Let me tell you something. As a seasoned expert in pharmaceuticals, I've seen it all. Biosimilars are the future, but you all don't get it. It's not just about money; it's about innovation. The FDA has approved these drugs for a reason. You need to trust the process. The insurance companies are doing their job, but they're being pressured by the big pharma lobby. It's a complex system. I've read all the studies. The data shows that biosimilars are safe and effective. You should all listen to me. I've been in this field for 20 years. Trust me. 😎 Also, the government needs to step in. It's not just about the US; it's a global issue. We need international cooperation. Don't you see? It's all connected. Think about it. 😎