Every year, thousands of seniors face surprise increases in their medication costs-not because prices went up, but because their insurance plan changed where their drug sits on the formulary. If you’re on Medicare Part D or a private plan with drug coverage, you need to know how to check your drug’s tier and track changes before they hit your wallet. It’s not complicated, but if you don’t check, you could be paying $50 more a month for a pill you’ve taken for years.

What Is a Drug Formulary and Why Does It Matter?

A drug formulary is just a list of medications your insurance plan covers. But it’s not just a simple list-it’s broken into tiers. Each tier has a different cost to you. The lower the tier, the less you pay. The higher the tier, the more you pay out of pocket. Most plans use either a 3-tier, 4-tier, or 5-tier system. Here’s how they usually break down:- Tier 1: Preferred generics. These are the cheapest. You might pay $5 or less per prescription.

- Tier 2: Non-preferred generics or lower-cost brand-name drugs. Expect $10-$20.

- Tier 3: Higher-cost brand-name drugs with generic alternatives. Copays often jump to $30-$50.

- Tier 4: Non-preferred brand-name drugs without generics. These can cost $60 or more.

- Tier 5: Specialty drugs. These are high-cost medications like injectables, cancer treatments, or newer weight loss drugs like Wegovy or Ozempic. Costs can be $100-$500 a month.

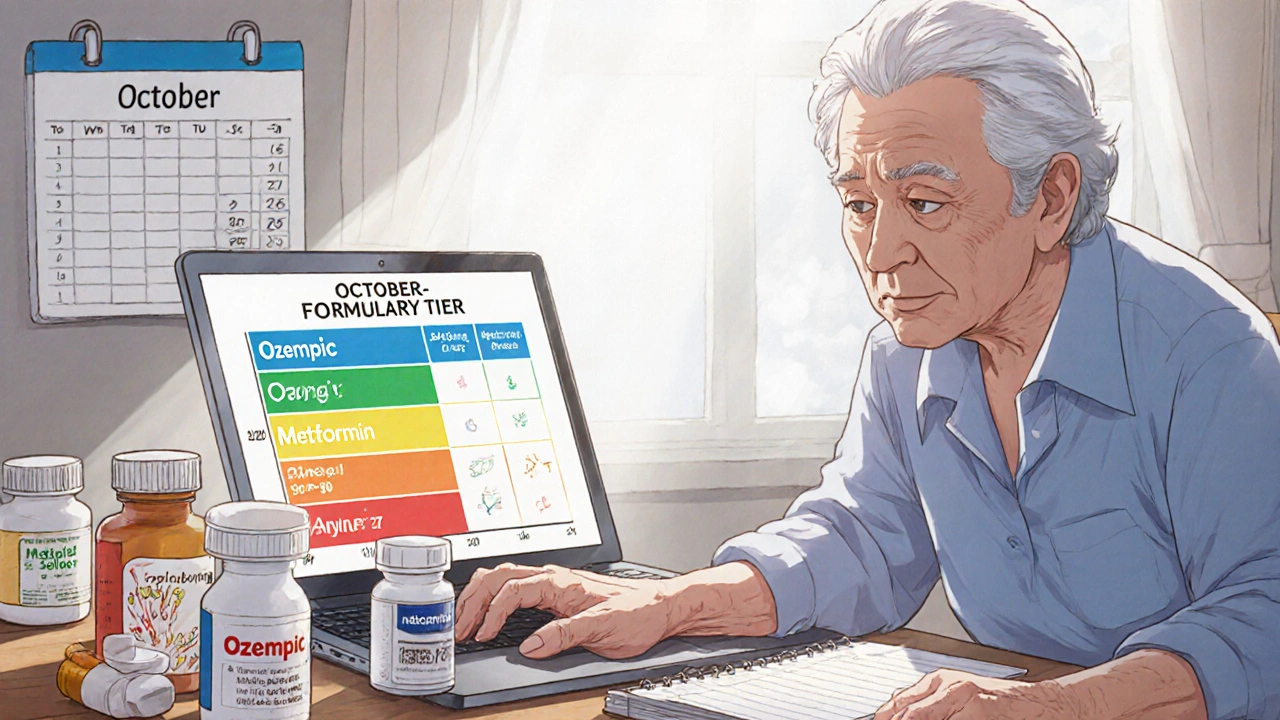

Here’s the catch: the same drug can be in different tiers across different plans. For example, metformin (a common diabetes drug) might be Tier 1 with one insurer and Tier 2 with another. That’s why checking your specific plan matters more than general advice.

How to Find Your Plan’s Formulary

You can’t guess your drug’s tier-you have to look it up. Every Medicare Part D plan and most private insurers offer a free online formulary search tool. Here’s how to find it:- Go to your plan’s official website (like Humana, Cigna, or Excellus BCBS).

- Look for a link labeled “Drug List,” “Formulary,” or “Find a Drug.”

- Enter the exact name of your medication-use the brand name if you’re unsure of the generic.

- Check the tier and your estimated cost (copay or coinsurance).

Some plans, like UnitedHealthcare, make this easy with a clean search interface. Others are clunky. If you’re stuck, call customer service. They’re required to help you. You can also use Medicare.gov’s Plan Finder tool to compare multiple plans at once.

Pro tip: Always check the formulary after you enroll or renew your plan. Plans update their lists every January 1st. But changes can happen anytime.

When Formularies Change (And How You’ll Know)

Plans can change their formularies during the year-not just at renewal. They might move a drug to a higher tier, remove it entirely, or add new restrictions like prior authorization.Here’s what triggers a change:

- A new generic version becomes available (and the plan wants to save money).

- New safety data emerges about a drug.

- A drug gets pulled from the market.

- Costs for a drug spike unexpectedly.

By law, your plan must notify you 60 days in advance if they’re removing a drug or adding new restrictions. But if they’re just moving it to a higher tier, they only need to tell you in their annual notice-usually mailed in October.

That’s the problem. Most people throw that letter away. Don’t. Open it. Look for your medications.

And here’s something even fewer people know: if your drug is changed mid-year and you’re already taking it, your plan must let you keep it for at least 30 days. That’s called a “transition policy.” Use that time to talk to your doctor about alternatives or file an exception.

What to Do If Your Drug Moves to a Higher Tier

If your blood pressure pill, diabetes med, or cholesterol drug suddenly jumps from $10 to $50 a month, you’re not stuck. You have options.- Ask your doctor for a generic alternative. Many brand-name drugs have cheaper generic versions that work just as well. For example, lisinopril is the generic for Zestril and Prinivil.

- Request a formulary exception. You can ask your plan to cover your drug at a lower tier if it’s medically necessary. Your doctor fills out a short form explaining why you need it. Approval rates range from 55% to 82%, depending on your plan and how strong the medical reason is.

- Use a 30-day transition supply. If your drug was removed or moved, you can get one more 30-day refill at the old cost. Use that time to switch or appeal.

- Check GoodRx or SingleCare. Sometimes, the cash price at your pharmacy is cheaper than your copay-even on Tier 5. These apps show real-time prices at local pharmacies.

One senior in Michigan told her pharmacist she couldn’t afford her new $65 copay for her heart medication. The pharmacist found a similar drug on Tier 2. Her new copay: $12. She didn’t need to file an exception. She just needed someone to look.

Why GLP-1 Weight Loss Drugs Are Changing Everything

In 2025, the biggest formulary shift is happening with weight loss drugs like Wegovy, Ozempic, and Mounjaro. These drugs are now among the most prescribed for seniors, especially those with diabetes or obesity.But here’s the problem: most plans now put them in Tier 5. That means you could pay $1,000 a month out of pocket-unless you get an exception.

Insurance companies say they’re doing this because the drugs are expensive. But experts say they’re also trying to limit use since these drugs aren’t yet approved for weight loss in Medicare Part D. That’s a gray area. Many seniors are being denied coverage-even though they’re using them for diabetes, which is covered.

If you’re on one of these drugs, check your formulary now. If it’s in Tier 5, ask your doctor to submit an exception based on your medical need-not just weight loss. Many approvals are granted when the reason is “type 2 diabetes management.”

Who Can Help You Navigate This?

You don’t have to figure this out alone.- SHIP (State Health Insurance Assistance Program): Free, local counselors who help seniors understand Medicare. They helped 1.7 million people in 2022.

- Your pharmacist: Pharmacists know formularies inside and out. Ask them if there’s a cheaper alternative.

- Your doctor: Don’t be afraid to say, “This drug just got a lot more expensive. Can we switch?”

- Medicare Rights Center: Offers free advice on formulary exceptions and appeals.

Don’t wait until you’re at the pharmacy counter with a $100 bill. Check your formulary every fall, before open enrollment. Make a list of your meds. Keep a copy. Update it every time you get a new plan notice.

Common Mistakes Seniors Make

Here’s what trips people up:- Thinking “my plan covers it” means “it’s cheap.” Coverage doesn’t equal affordability.

- Not checking after plan renewal. Changes happen every January.

- Assuming the same drug is in the same tier across plans. It’s not.

- Not asking for exceptions. 31% of people who need them don’t apply.

- Ignoring pharmacy cash prices. Sometimes, paying cash is cheaper than using insurance.

One man in Florida kept paying $45 a month for his cholesterol drug. He finally checked GoodRx and found the same pill for $12 at Walmart. He stopped using insurance for it. He saved $396 a year.

What’s Coming in 2025-2026

The government is pushing for simpler formularies. By 2025, Medicare may standardize on a 4-tier system across all Part D plans. That could make things easier. But it also means more drugs could move into higher tiers as plans try to control costs.Also, 78% of insurers plan to use AI tools by 2025 to recommend cheaper alternatives to patients. That’s good-if the system works. But right now, many seniors still get lost in the process.

Bottom line: the system isn’t broken. But it’s designed to save insurers money-not to make life easy for you. The only way to protect yourself is to stay informed.

How often do drug formularies change?

Formularies are updated annually on January 1st, but changes can happen anytime during the year. Plans must notify you 60 days in advance if they remove a drug or add restrictions. For tier changes (like moving a drug to a higher cost level), they only need to mention it in their annual notice, usually sent in October.

Can I get my drug covered if it’s not on the formulary?

Yes. You can file a formulary exception request. Your doctor must write a letter explaining why the drug is medically necessary for you. Most plans approve 55% to 82% of these requests, especially if there’s no effective alternative. Don’t assume you’re out of luck-ask.

Why is my generic drug now more expensive?

Even generics can be moved to higher tiers. Sometimes, a plan decides a generic isn’t “preferred” anymore-maybe because they’ve added a cheaper alternative, or because the manufacturer raised prices. Always check the tier, not just the label. A generic on Tier 2 can cost more than a brand-name drug on Tier 1.

Should I switch plans just because my drug moved tiers?

Not necessarily. Wait until open enrollment (October 15-December 7). Compare all plans using Medicare.gov’s Plan Finder. Look at your top 3 medications, not just one. A plan that’s cheaper for your blood pressure pill might be more expensive for your diabetes drug. Total cost matters more than one drug.

What if I can’t afford my medication after a tier change?

Call your plan immediately. Ask about a transition policy-you may get a 30-day supply at the old price. Also, ask your pharmacist about patient assistance programs or manufacturer coupons. Some drugmakers offer free or discounted meds to seniors who qualify. Don’t skip doses-there are solutions.

If you take even one prescription regularly, checking your formulary isn’t optional-it’s essential. A 15-minute search every fall can save you hundreds, or even thousands, a year. Don’t wait until the pharmacy tells you your copay jumped. Be the one who finds out first.

John Mackaill

November 22, 2025 AT 20:24I used to ignore my formulary until my insulin jumped from $12 to $78. Now I check every October like clockwork. Took me three years and a near-bankruptcy to learn this lesson. Don’t be like me.

Pharmacists know more than your doctor sometimes. Just ask.

And yes, GoodRx saved me $400 last year. Cash is king when insurance plays games.

Adrian Rios

November 24, 2025 AT 13:25Let me tell you something-this whole system is a goddamn circus. I’ve been on Medicare Part D for six years now, and every single year it’s the same script: you think you’re covered, then January 1st hits and suddenly your blood pressure med costs more than your electric bill.

I remember last year my doctor prescribed a generic version of my cholesterol drug-same active ingredient, same manufacturer, same pill-but because it wasn’t on the ‘preferred’ list, I was slapped with a $45 copay. Meanwhile, the brand-name version? Tier 1. $10. No joke.

I called my plan. I called my pharmacist. I called my niece who works at a health insurance startup. Turns out, they’d swapped out the preferred generic because the manufacturer raised prices by 3%-so they punished the patient instead of negotiating.

And don’t get me started on the annual notice they mail in October. It’s printed in 6-point font, folded into a brochure that’s 18 pages long, and buried under ads for dental implants and hearing aids. No wonder people miss it.

Here’s what I do now: I print out my entire list of meds every September. I go to Medicare.gov, I plug them all in, I compare every single plan side by side. I don’t just look at premiums-I look at copays, deductibles, specialty tier rules, and even which pharmacies are in-network. And I do it every year. Because if you don’t, you’re not being careful-you’re being stupid.

And yes, I’ve filed exceptions. Twice. Both times approved. One time because I literally cried on the phone to the rep. The other time because my doctor wrote a three-page letter citing clinical guidelines. Either way, it worked.

Don’t wait until you’re at the counter with your card declined. Be the guy who shows up with a spreadsheet. They don’t want you to do this. But you have to anyway.

Casper van Hoof

November 25, 2025 AT 12:25The structural inefficiencies inherent in the current formulary management paradigm reflect broader systemic failures in the commodification of pharmaceutical care. While individual agency-such as consulting pharmacists or utilizing GoodRx-is commendable, it functions as a palliative rather than a curative intervention. The absence of centralized, standardized, and transparent tiering protocols across insurers constitutes a regulatory lacuna that disproportionately burdens elderly, cognitively vulnerable, and economically marginalized populations. One is compelled to question whether the current model prioritizes actuarial risk mitigation over therapeutic continuity and patient autonomy.

Furthermore, the reliance on physician-initiated exceptions as a primary recourse implies an undue burden on clinical staff, who are neither trained nor compensated to function as insurance navigators. The proliferation of AI-driven formulary recommendations, while ostensibly efficiency-enhancing, may exacerbate algorithmic bias if training datasets lack demographic representativeness. In sum, the onus should not rest upon the patient to become a de facto healthcare economist.

Legislative intervention, perhaps through the creation of a federally mandated formulary transparency index, is not merely advisable-it is ethically imperative.

Manjistha Roy

November 25, 2025 AT 13:52My mother just got her new plan notice last week. She didn’t understand a word of it. I sat with her for two hours, printed out the formulary, highlighted her meds, and found that her diabetes pill had moved from Tier 1 to Tier 3. We called the pharmacist. They had a cheaper generic we didn’t even know about. She’s saving $50 a month now.

Don’t let your parents suffer in silence. Help them. Even if it’s just one time.

It’s not hard. Just take the time.

Olanrewaju Jeph

November 26, 2025 AT 22:27Many seniors do not realize that formulary changes are not always communicated clearly. Insurance companies are not obligated to notify patients individually when a drug’s tier is adjusted, only to include the information in the annual summary. This is a critical gap in consumer protection.

Moreover, the transition policy-allowing a 30-day supply at the previous tier-is often misunderstood. Patients believe they can continue using the old pricing indefinitely, but the window is strictly limited. I recommend keeping a physical copy of your formulary, updating it immediately upon receipt of any notice, and setting calendar reminders for October 1st each year.

Also, pharmacists are underutilized resources. They have direct access to real-time pricing and can often identify therapeutic alternatives that are both clinically equivalent and financially advantageous. Do not hesitate to ask.

Finally, while GoodRx is a valuable tool, it is not a substitute for insurance. Always compare the cash price with your copay, but remember that using GoodRx may not count toward your deductible. Consider your long-term financial strategy, not just immediate savings.

Dalton Adams

November 27, 2025 AT 14:57LMAO. You people are acting like this is some kind of conspiracy. It’s capitalism, folks. Insurance companies are for-profit entities. They don’t care if you can afford your meds-they care if they make money.

And guess what? You’re the sucker who lets them get away with it. You don’t check your formulary? You don’t call your pharmacist? You don’t use GoodRx? Then you deserve to pay $65 for a pill.

Also, if you’re on Ozempic and your plan won’t cover it, you’re probably using it for weight loss, not diabetes. That’s why it’s Tier 5. Stop pretending it’s a medical necessity when your BMI is 28. 😏

And for the love of god, stop asking your doctor to write a letter for an exception. They’re already overworked. Do your own damn research. I’ve got a spreadsheet that tracks every drug I take across 12 plans. It’s a hobby. You should try it.

Also, if you’re not using SingleCare, you’re literally leaving money on the table. I paid $8 for my blood pressure med last month. Insurance wanted $42. I didn’t even use my card. Cash. Boom. 🤑

And yes, I know more about Medicare than your ‘SHIP counselor.’ I’ve read the entire CMS manual. You haven’t. So stop asking me to ‘be nice’ about it. This isn’t a support group. It’s survival.

Kane Ren

November 29, 2025 AT 09:04Just wanted to say-you’re not alone. I was terrified last year when my heart med jumped from $15 to $60. Thought I’d have to choose between food and pills.

But I called my pharmacist. She found a different generic that worked just as well. Same pill, different name. Copay: $12.

It took 10 minutes. No paperwork. No yelling.

You’ve got this. And if you need help, just ask. Someone out there’s been there.

Charmaine Barcelon

November 30, 2025 AT 21:29You’re all being so dramatic. It’s just a pill. If you can’t afford it, maybe you shouldn’t be taking it.

I’ve been on Medicare for 12 years. I never had a problem. You just need to stop being lazy.

And stop blaming the insurance companies. They’re just doing their job. You’re the one who didn’t read the fine print.

Also, GoodRx? That’s for people who don’t know how to use their own insurance. Pathetic.

My doctor told me to take my meds. I take them. No fuss. No drama.

Stop whining. Just take your pill and move on.