Drug Coverage Tiers: How Your Insurance Picks What You Pay For

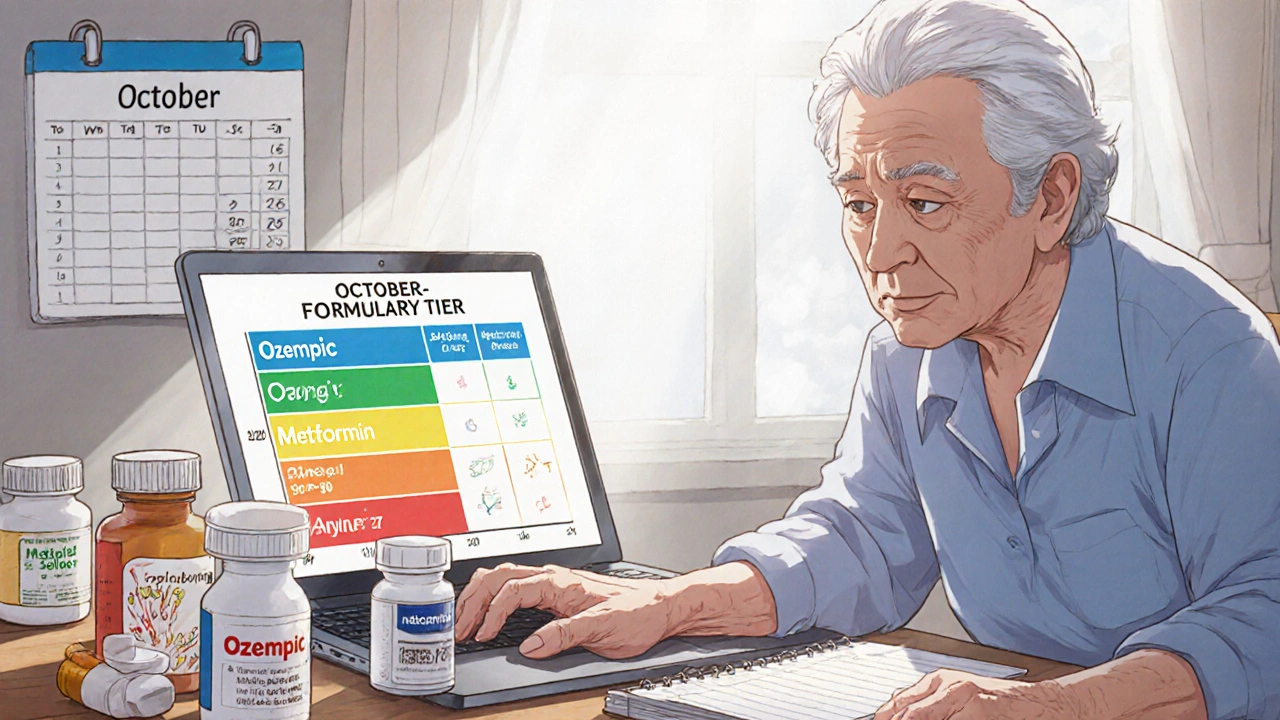

When you pick up a prescription, the price you pay isn’t just set by the drug company—it’s decided by your drug coverage tiers, a system insurers use to group medications by cost and clinical value. Also known as a formulary, this tier structure determines whether you pay $5, $30, or $150 for the same pill your neighbor got for $10. It’s not random. Every drug your plan covers is sorted into one of four or five levels, based on how much it costs, whether a generic version exists, and how often doctors prescribe it.

Most plans use Tier 1, the lowest-cost category, usually for generic drugs with proven safety and effectiveness. These are your go-to options—think metformin for diabetes or lisinopril for blood pressure. Tier 2, includes preferred brand-name drugs that your insurer has negotiated lower prices on. If you need a brand, this is where you want to be. Tier 3, is for non-preferred brands—same drug, same effect, but more expensive because the insurer didn’t get a good deal. Then comes Tier 4, the specialty tier, where drugs like cancer treatments, biologics, or rare disease meds land. These can cost hundreds or even thousands, and often require prior authorization. Some plans even have a Tier 5 for the most expensive therapies.

Why does this matter? Because your out-of-pocket cost jumps with each tier. A Tier 1 drug might cost you $5 with a $10 copay. A Tier 4 drug? Maybe 33% of the total price. That’s why people end up skipping doses or switching meds—they can’t afford it. But here’s the thing: you’re not stuck. You can ask your doctor for a tier 1 or 2 alternative. You can request a tier exception if your drug is medically necessary. And you can check your plan’s formulary every year—insurers change their tiers often.

Some of the posts below show how people deal with these realities. One explains how generic medications are just as effective but often get stuck in higher tiers due to marketing, not science. Another digs into how drug interactions like omeprazole blocking clopidogrel can push a drug out of preferred status. There’s even a piece on how medication shortages force insurers to move drugs to higher tiers overnight. And if you’re worried about opioid safety or liver injury from painkillers, you’ll see how tier systems sometimes restrict access to safer options, not just cheaper ones.

You don’t need to guess what your plan covers. You just need to know how to read the system. The articles below give you real stories, real data, and real ways to fight back when the tiers work against you—not for you.

How to Check Drug Coverage Tiers and Formulary Changes for Senior Medications

Nov, 21 2025