Formulary Changes: What They Mean for Your Medication Access and Costs

When your insurance company makes a formulary change, a list of approved drugs covered by your health plan. Also known as a drug formulary, it determines which medications your plan will pay for—and which ones won’t. These aren’t just administrative tweaks. A single formulary change can stop your doctor from prescribing your usual pill, push you toward a cheaper alternative, or leave you with a $200 out-of-pocket bill overnight.

Formulary changes happen for a few real reasons: drug prices spike, new generics hit the market, or a drug gets flagged for safety issues. Your insurer might drop a brand-name drug because a generic version is now available and costs 80% less. Or they might add a new drug to the list because clinical trials show it works better. But here’s the catch: they don’t always tell you in advance. You might show up at the pharmacy and find your medication is no longer covered. That’s not a glitch—it’s standard practice. And it’s why knowing how formularies work matters more than ever.

These shifts don’t just affect your wallet. They can mess with your treatment. If you’re on a stable dose of a drug that gets removed from the formulary, switching to a new one—even if it’s "equivalent"—can cause side effects, reduce effectiveness, or trigger anxiety. That’s especially true for medications like antidepressants, blood pressure drugs, or thyroid pills. Your body adapts. So does your routine. A formulary change can break that balance.

But you’re not powerless. Pharmacies often have tools to check formulary status before you fill a prescription. Your doctor can request a prior authorization if a drug was removed. And sometimes, a simple appeal works. Many people don’t realize they can challenge a formulary decision. In fact, a 2023 study from the American Journal of Managed Care showed that over 40% of formulary denials were overturned after a patient or provider appealed.

Formulary changes also tie into bigger issues like medication access, how easily patients can get the drugs they need and prescription costs, the out-of-pocket price you pay after insurance. When insurers favor certain brands or require step therapy—trying cheaper drugs first—you’re stuck in a loop of trial and error. That delays treatment. It adds stress. And it can lead to people skipping doses or quitting altogether.

Look at the posts below. They’re not random. Each one connects to how formulary decisions ripple through real lives: someone struggling to get their generic antidepressant covered, another facing a sudden switch from omeprazole to a less effective PPI, or a senior forced to choose between blood pressure meds and groceries because their formulary dropped a key drug. These aren’t abstract policy issues. They’re daily battles.

What follows is a collection of real stories and practical guides on how to navigate these changes. You’ll find advice on how to check your formulary, how to talk to your pharmacist about alternatives, and what to do when your drug disappears overnight. You’ll learn how to spot when a formulary change is hiding a cost-cutting move—not a clinical improvement. And you’ll see how others fought back and won.

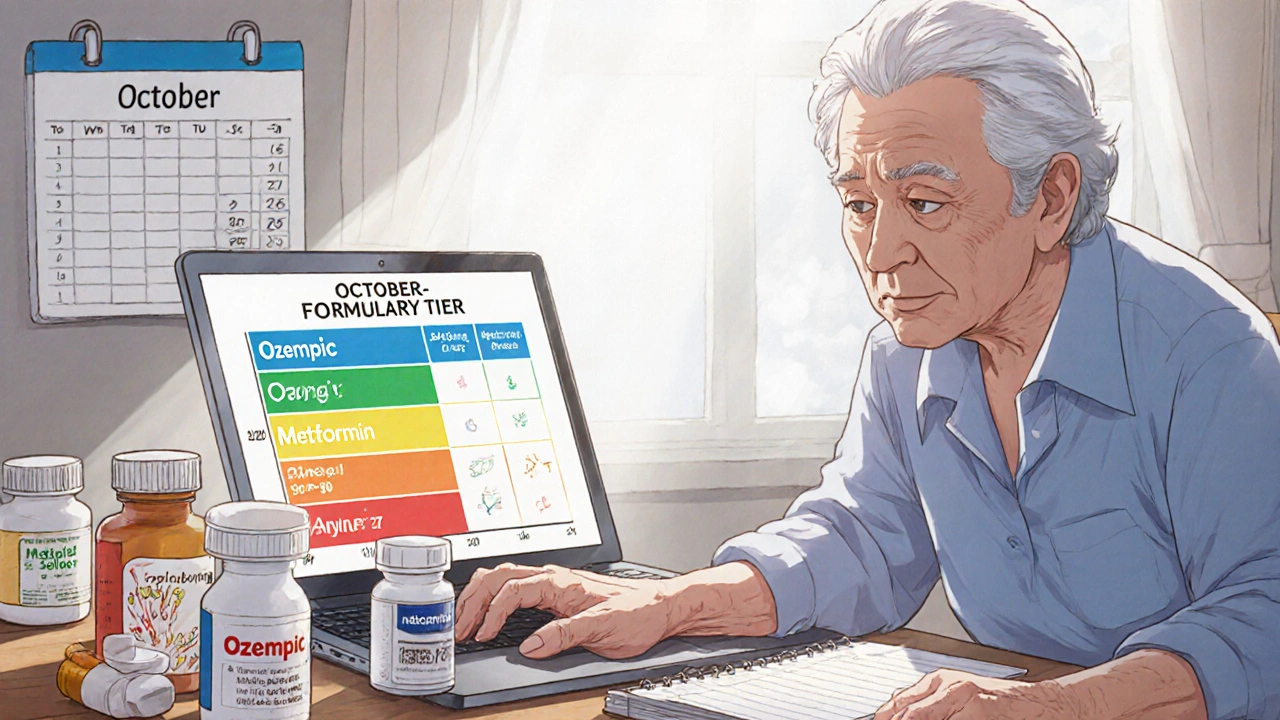

How to Check Drug Coverage Tiers and Formulary Changes for Senior Medications

Nov, 21 2025