Senior Medication Costs: How to Save on Prescriptions Without Risk

When you’re over 65, senior medication costs, the total out-of-pocket price older adults pay for prescription drugs each year. Also known as elderly prescription drug expenses, they’re one of the biggest budget shocks after retirement. Many seniors take five or more medications daily—blood pressure pills, diabetes drugs, pain relievers, heart meds—and each refill adds up. The average U.S. senior spends over $1,200 a year just on prescriptions, and that’s before insurance copays or gaps in coverage. It’s not just about price—it’s about safety, too. A wrong dose, a fake pill, or a dangerous interaction can land you in the hospital faster than you think.

That’s why Medicare drug coverage, the part of Medicare that helps pay for outpatient prescription medications. Also known as Part D, it is critical—but it’s not enough. Many plans have high deductibles, narrow formularies, or surprise cost spikes during the coverage gap (the "donut hole"). And even when coverage exists, brand-name drugs often cost three to ten times more than their generic versions. Yet, many seniors still avoid generics because they’re afraid they won’t work as well. Studies show generics are just as safe and effective, but perception matters more than science. That’s where real-world stories from other seniors—like those shared in support groups—make all the difference.

Then there’s the risk of counterfeit drugs. Fake pills sold online look real but might have no active ingredient, or worse—they might contain fentanyl, rat poison, or industrial chemicals. The FDA warns that 1 in 10 medications bought from unlicensed online pharmacies are fake. Seniors are targeted because they’re more likely to search for cheaper options and less likely to report scams. You don’t need to risk your life to save money. Safe alternatives exist: licensed offshore pharmacies, patient assistance programs, mail-order discounts, and even pharmacy loyalty cards that cut prices by 80% on common drugs like metformin or lisinopril.

And it’s not just about buying cheaper pills—it’s about using them right. Some seniors take multiple drugs that clash, like ACE inhibitors with kidney problems or omeprazole with clopidogrel, which can reduce heart drug effectiveness. Others store opioids in open medicine cabinets, putting kids or grandkids at risk. A simple lockbox can prevent overdose. Others don’t know how to read warning labels, missing boxed warnings or drug interaction alerts. These aren’t minor issues—they’re life-or-death mistakes that happen every day.

Below, you’ll find real guides written for people just like you. No fluff. No jargon. Just clear advice on how to cut senior medication costs without cutting corners. Learn how to spot fake pills, why generics are safe, how to avoid dangerous drug combos, and where to find legitimate discounts—even if you’re on Medicare. You’ll see how other seniors saved hundreds, even thousands, by making small, smart changes. Some switched to mail-order pharmacies. Others found patient assistance programs through their drug makers. A few started using pill organizers and lockboxes to stay safe. Every article here is based on real experiences and medical facts—not marketing hype.

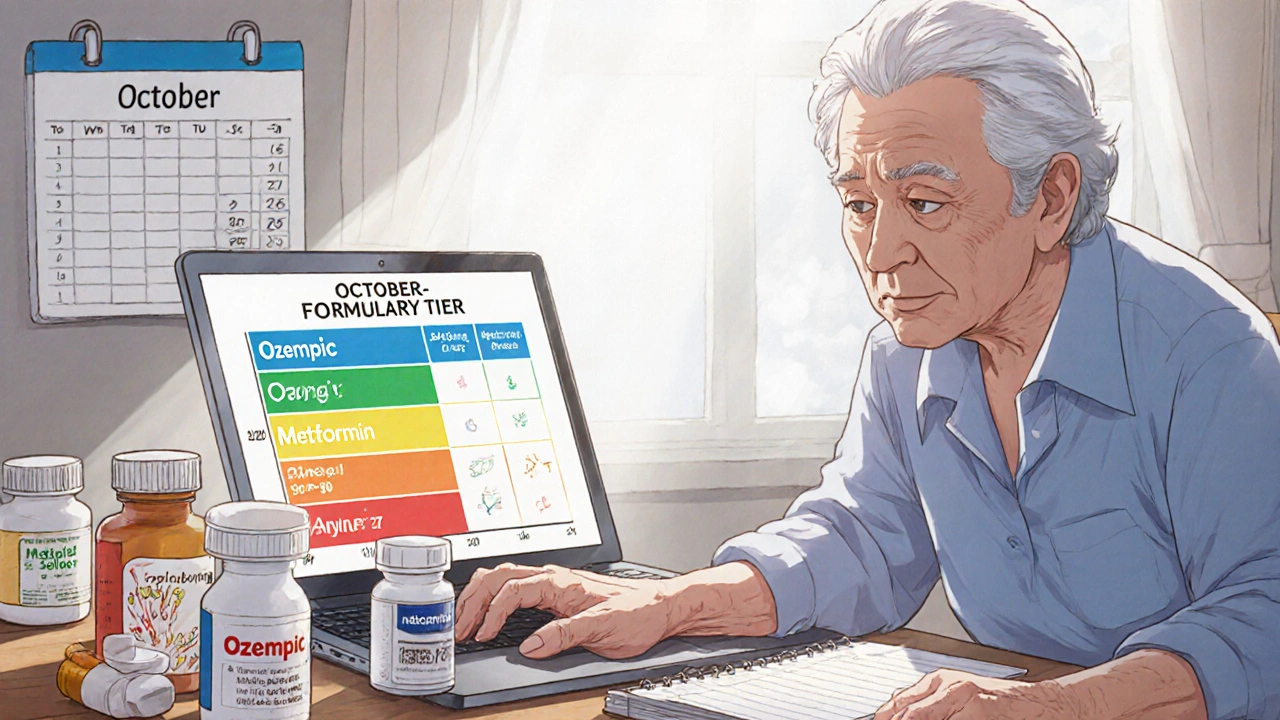

How to Check Drug Coverage Tiers and Formulary Changes for Senior Medications

Nov, 21 2025