Medicare Part D: What It Covers, How It Works, and How to Save on Prescriptions

When you enroll in Medicare Part D, a federal program that helps pay for prescription drugs for people on Medicare. Also known as Medicare prescription drug coverage, it’s not automatic—you have to pick a plan, and the choices matter a lot. Many people pay way more than they need to because they don’t understand how deductibles, tiers, and coverage gaps work. If you’re on a fixed income, this isn’t just paperwork—it’s about whether you can afford your heart meds, insulin, or arthritis pills next month.

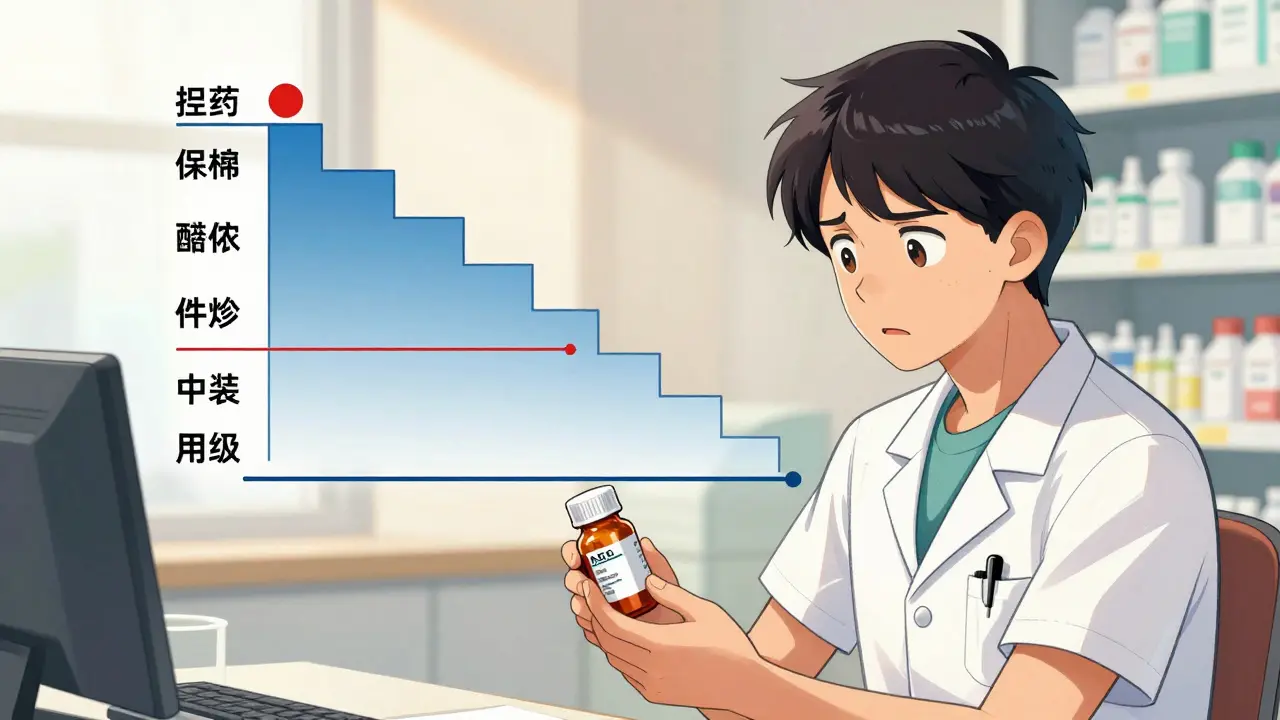

Prescription drug coverage, the core function of Medicare Part D. Also known as drug plans, it’s offered by private companies approved by Medicare. These plans group drugs into tiers: generics on tier 1 cost the least, brand-name and specialty drugs on higher tiers cost more. Some plans have a coverage gap—called the donut hole—where you pay full price until you hit a spending threshold. Once you’re out, you get catastrophic coverage, but only after spending thousands. That’s why knowing your meds’ tier and checking if your pharmacy is in-network saves hundreds a year. And if you’re buying cheaper meds offshore, you’re not alone. Thousands use Part D to cover some drugs and turn to trusted international pharmacies for others, especially when the U.S. price is double or triple what you’d pay elsewhere.

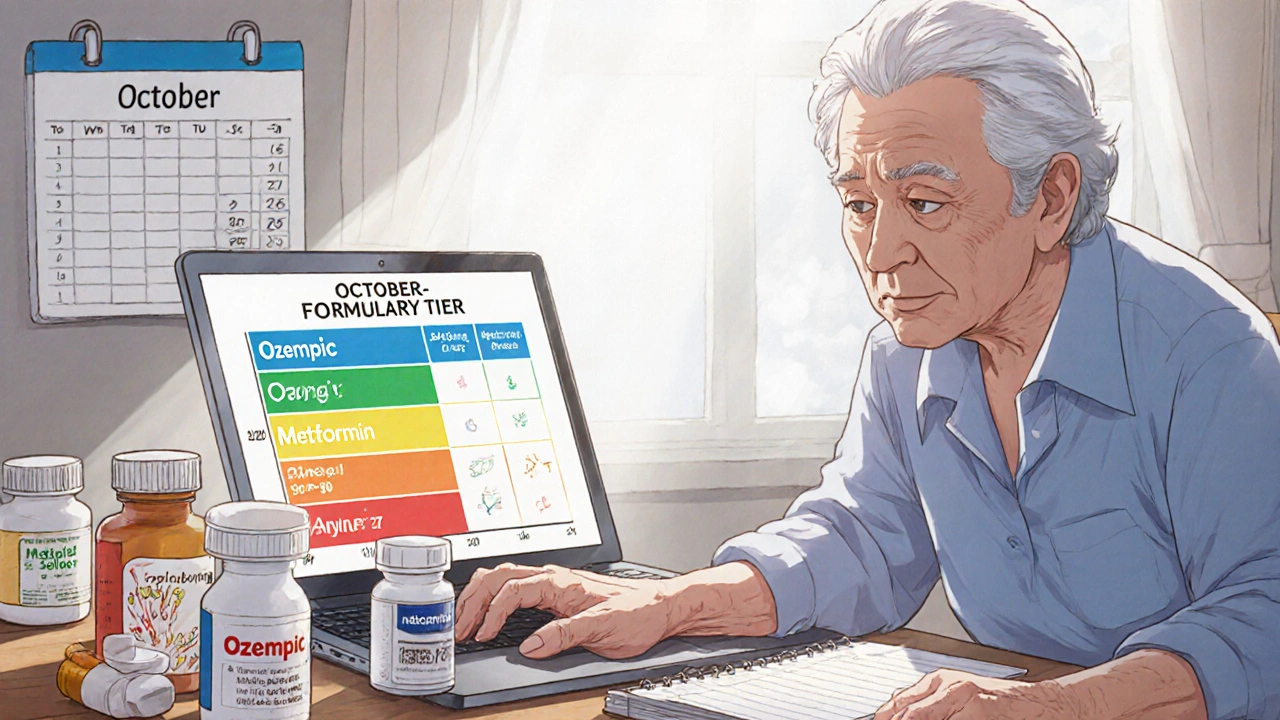

Medicare plans, the different options you can choose from to get Part D coverage. Also known as stand-alone Part D plans or Medicare Advantage plans with drug coverage, they vary wildly in cost and coverage. A plan that covers your blood pressure meds might not cover your diabetes pills, or vice versa. Some have $0 premiums but high copays. Others charge more upfront but cut your out-of-pocket costs after you hit the donut hole. You can’t just pick the cheapest—you have to match the plan to your actual meds. Use the Medicare Plan Finder tool, but don’t trust it blindly. Always check the formulary, ask your pharmacist, and read the fine print on what’s excluded. And if you’re struggling with costs, you might qualify for Extra Help—a federal program that lowers your monthly premiums, deductibles, and copays. It’s not widely advertised, but it’s available to people with limited income.

What you’ll find below are real, practical stories and guides from people who’ve been there. How to avoid getting hit with a surprise bill when your insulin price jumps. How to spot if your Part D plan drops your drug mid-year. How to legally buy cheaper versions of the same pills from offshore pharmacies without risking your health. You’ll see how generic medications fit into the Part D puzzle, why some seniors switch plans every year, and how drug shortages are forcing people to rethink their options. This isn’t theory. These are the things people are dealing with right now—and how they’re saving money, staying safe, and staying on their meds.

Biosimilars Insurance Coverage: Prior Authorization and Tiers Explained in 2026

Feb, 5 2026

How to Manage Medication Costs During Medicare Part D Coverage Gaps (Donut Hole) in 2024-2025

Dec, 5 2025

How to Check Drug Coverage Tiers and Formulary Changes for Senior Medications

Nov, 21 2025